Overview

Sometimes, how a computer system does accounting will be different than how traditional accountants does accounting.

One of the subjects that always come up for debate is how COGS (Cost of Goods Sold) is calculated.

The Postings

In Dynamics 365 Business Central, when a purchase of inventory is made, 4 General Ledger accounts are hit:

- Inventory

- A/P

- Purchases

- Direct Cost Applied

When the items are sold, 4 General Ledger accounts are hit:

- Inventory

- A/R

- Sales

- COGS

In this case, the COGS is automatically calculated and posted to your COGS account. How Dynamics 365 Business Central calculates COGS is based on your Costing Method in conjunction with running the Adjust Cost – Item Entries process.

The COGS posted by Business Central is ALWAYS correct. Don’t assume otherwise!

How Accountants Calculate COGS

Typically, when a CPA (Certified Public Accounts) report COGS, it’s calculated and displayed based on the following formula:

Beginning Inventory

+ Purchases (for the period)

– Inventory Adjustment (for the period)

– Ending Inventory

= COGS (Cost of Goods Sold)

This formula gives all sorts of problems when trying to produce a proper financial statement to the CPA to do their tax returns in Business Central.

What ends up happening is that company will believe they need to purchase all sorts of fancy reporting tools when the out of the box Account Schedules functionality will work just fine.

This calculation is actually pretty easily defined in the NAV account schedules.

Let’s say you have the following Chart of Accounts:

14300 – Inventory

53100 – Purchases

53700 – Direct Cost Applied

53400 – Inventory Adjustment

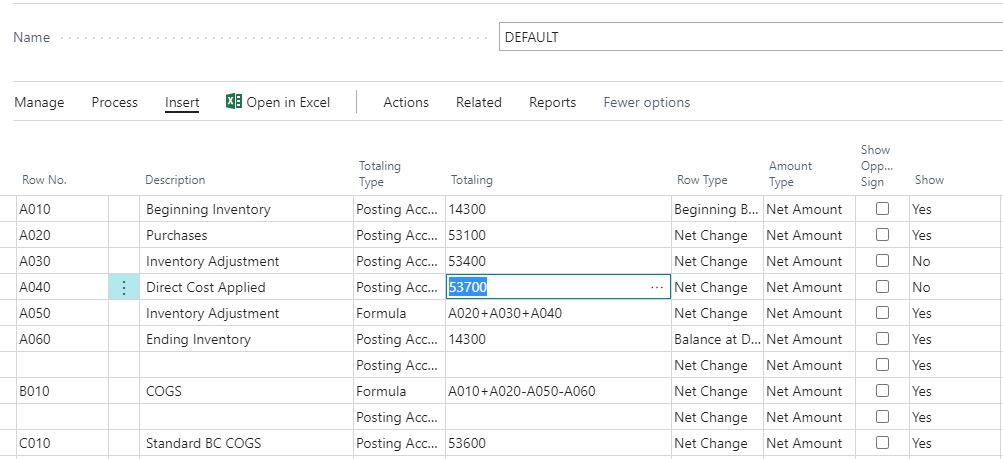

The way to set the formula to give the proper COGS based on the CPA formula on the Account Schedules is the following:

A010 – Beginning Inventory (Row Type = Beginning Balance)

A020 – Purchases (Row Type = Net Change)

A030 – Inventory Adjustment (Row Type = Net Change) Set it to NOT show

A040 – Direct Cost Applied (Row Type = Net Change) Set it to NOT show

A050 – Inventory Adjustment (Formula = A020 + A030 + A040)

A060 – Ending Inventory (Row Type = Balance at Date)

B010 – COGS (Formula = A010 + A020 – A050 – A060)

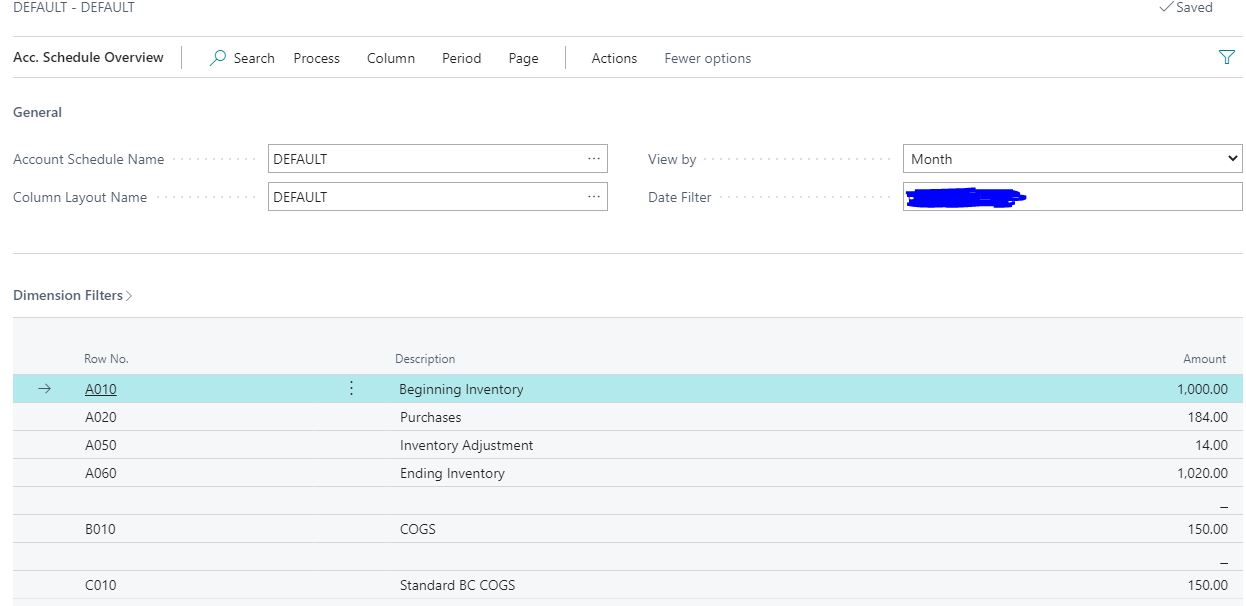

After you setup the accounts schedule, you can use the Overview functionality to check your work.

In this example, I used the standard Business Central COGS account to check my work.

Boom! The COGS I calculated and the standard BC COGS matches! Good to go!

What was the point for lines A040 to A060? (Read only if you’re interested in the accounting and costing aspect of it)

The reason why we need to set this up is because of purchase returns. When items are returned using the purchase return order (or purchase credit memo), the cost being used to return the product is deducted based on your costing method, NOT what you typed in as the direct unit cost on the purchase return/credit.

Confused? Don’t be.

Let me explain, when you invoice a purchase order for $10.00 for item A, the following happens:

– $10.00 Accounts Payable

+ $10.00 Inventory

+ $10.00 Purchases

– $10.00 Direct Cost Applied

Now, suppose you need to return this product to the vendor and the vendor is only willing to give you credit for $8.00. When you post the credit memo, the following will happen:

+ $8.00 Accounts Payable

– $8.00 Inventory (assuming this is what’s on the Unit Cost (LCY) field on the purchase credit memo line)

– $8.00 Purchases

+ $8.00 Direct Cost Applied (assuming this is what’s on the Unit Cost (LCY) field on the purchase credit memo line)

Additional, NAV will make these 2 entries:

– $2.00 Inventory

+ $2.00 Direct Cost Applied

The extra $2.00 entries are posted because the cost of the item is $10.00. That’s the actual price paid for the item to the vendor so that’s the cost it’s should be relieved from inventory.

So you can say the sum of Purchases and Direct Cost Applied is the difference between vendor returns and the vendor purchases.

For most companies, these amounts are lumped together to be displayed under inventory adjustment on the income statement. You can separate it out as a different line item on your income statement if you wish.

It doesn’t matter if you turn on Exact Cost Reversing or if your client says “this doesn’t happen, we always use the same cost that we bought it at”. ALWAYS do this.

Conclusion

The formula gets a little more involved when you start involving Item Charges (landed cost assignments). You can play around with the account schedule to see if you’re able to get it going. If not, reach out!

This example assumes that you set Direct Posting to NO on the G/L accounts described.

As you understand the concept behind this, you can easily incorporate Item Charges, WIP, etc into this formula. Basically, everything that gets accrued into Inventory needs to be part of this formula.

Most companies would want to allocate additional line items into the calculation of COGS without accruing the expenses to the inventory. This is fine, you’ll just need to add the other costs into the formula. However, the total of your COGS will be different than Business Central’s COGS.

Separate from the point of this post, as a rule of both thumbs, you always turn off the Direct Posting field on the inventory accounts. Always. ALWAYS. No exceptions.

If you want to make G/L entries to the inventory account, create a separate Inventory G/L accounts and combine them together on your Account Schedules to have them appear as one when you present it to your CPA or auditors. Making G/L entries directly to the inventory accounts is a one way ticket to reconciliation headache between the Inventory Valuation and General Ledger.

If everything is setup properly, you’ll find that the COGS formula you setup will match, to the penny, the COGS account on your Chart of Account.