The Conversation

Recently, I had a meeting with an owner of a company that I thought was going to ripe me a new hole. This company originally purchased NAV from another solution center and overpaid for subpar service. Problems steming from wrong advice given to unnecessary modifications causing them delays in their operations. Noting this, they went to another solution center that did a wonderful presentation, but eventually suffered the same treatment as the original solution center that sold them the product. Basically, non-existent support and overbilling.

They eventually found us and after my interview with the owner of this company, I went through our company philosophy, how we approach customers, and what our princples are. We’re able to gain the trust of the owner and we soon put him at ease that we were the people they were looking for.

Then, the bombshell questions came. “Why are there no good company that service Navision (Dynamics NAV) out there?”. Followed by, “why didn’t we buy the software from you?” I have to admit, the 2nd question caught me off guard.

The Industry

It’s really not fair to say only Navision (Dynamics NAV) has this problem. The problem really applies to all of ERP industry, regardless of whether you sell Great Plains (Dynamics GP), SAP B1, Epicor, Oracle, etc. It’s all the same. Why are there no good service companies that cater to existing companies and users?

I pondered the same question. We obviously carved out a good niche providing excellent service to existing customers. It’s not like we’re smarter than other people doing ERP implementations. It’s not like we have more technical abilities.

With all the talk about our how our industry business model is built on having a long customer relationships, why is it that it’s so hard to find good solution centers that provides good service? That makes the customer want to stay with the company for many, many years?

It’s All About the Money

Yeah, you knew I was going here.

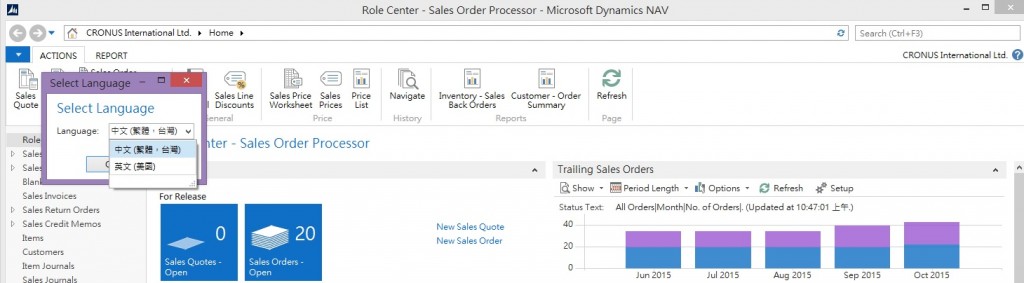

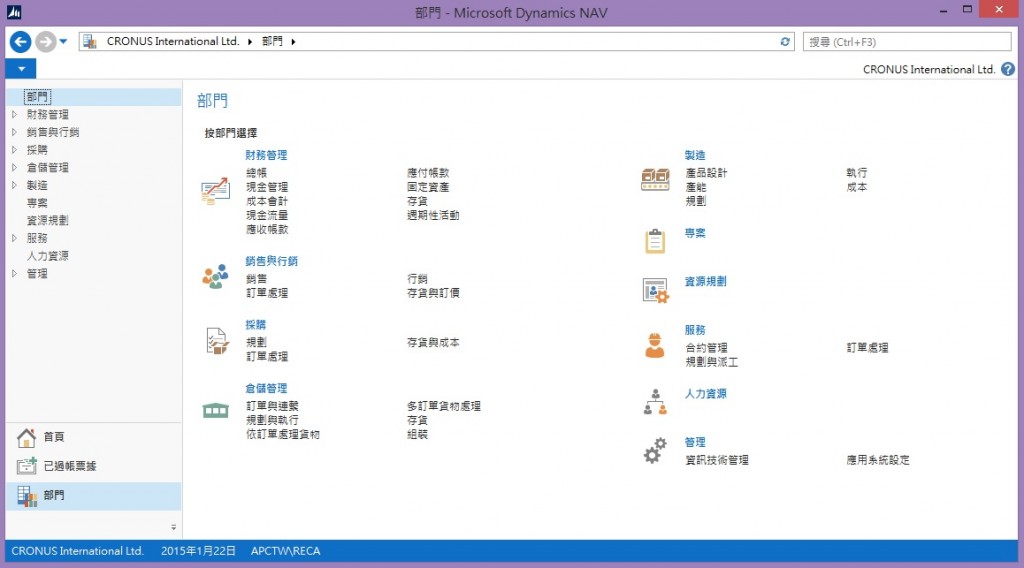

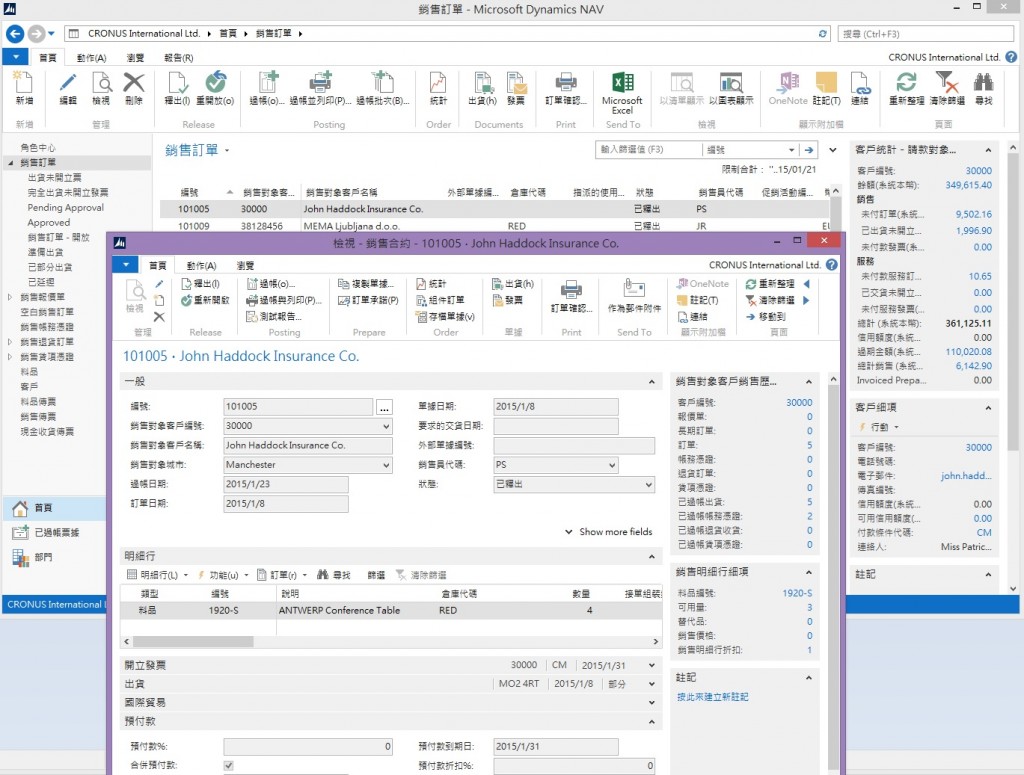

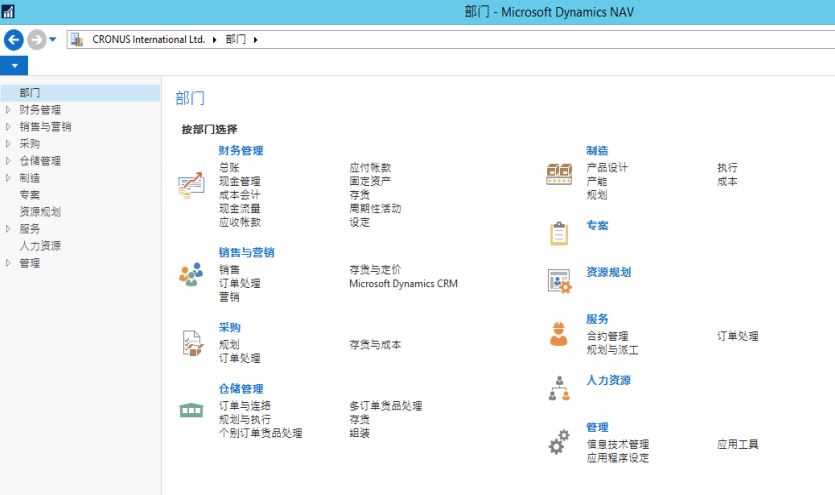

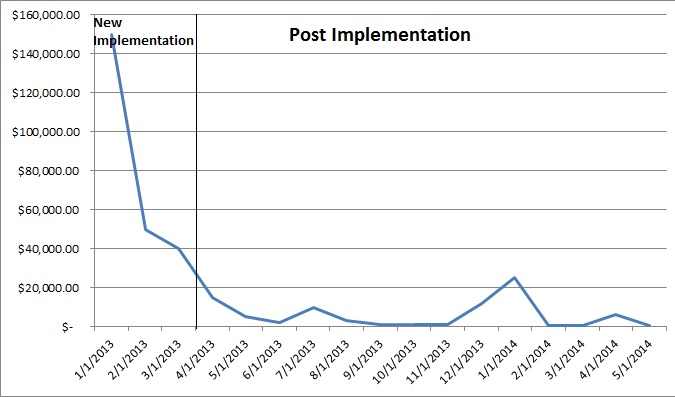

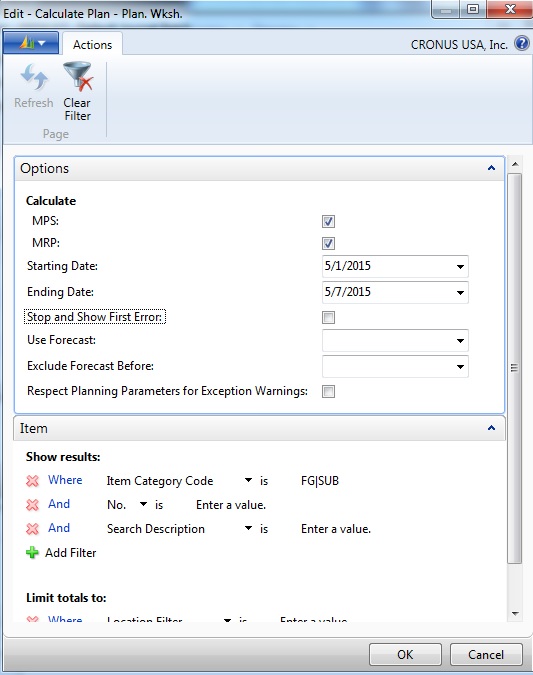

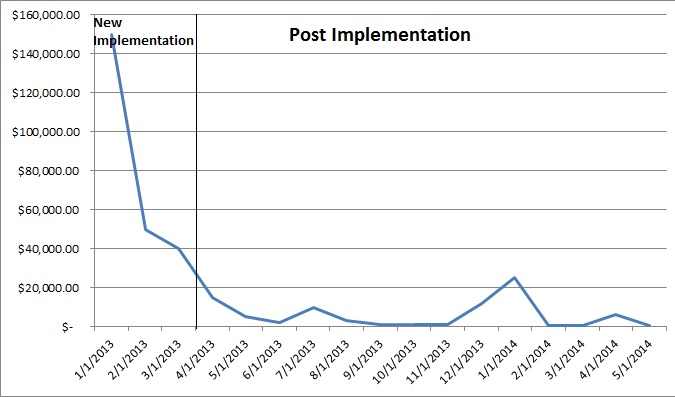

When you’re in the ERP or accounting software industry, the majority of the money from a customer is spent in new sales. Consider the following graph:

Assuming the customer is purchased the product in 1/1/13 and they went live on 4/1/13. In the first 3 months, the customer will have spent the majority of the total value of the entire implementation. The cost that you would’ve paid to the solution center will include the software license and the initital implementation.

The reason why you see a few bumps in the post implementation support is because after the customer is live with Navision, they will add on modules, users, etc. In addition, every year the customer (if they choose to) pay for the 16% enhancement. Sometimes the customer will even do an upgrade which will require some labor.

You can extend the graph out longer but it’s pretty much the same.

It will take many years, if ever (if the customer is not on the enhancement plan), for a service based company to match the same revenue obtained from a new sale in the first 3 months.

If you were to own a solution center, where do you want to be? Just looking at the graph, it’s a no brainer. To maximize revenue for a company, you absolutely have to focus on new sales and new implementation. Microsoft rewards you if you focus on the new sales. The owners of the company rewards you if you can bring in new sales.

High Risk and High Reward

Make no mistake about it, to focus on new sales is a tough business. You have to hire and manage a sales force. You have to have enough talented manpower to handle all of that new implementation. On top of that, you have to feed these talents even if you don’t make a sale.

So here’s the cycle, the cost of talent is not cheap. In order to feed this talent, you have to focus on new sales and drive in revenue. Basically, you have to feed the machine. This means that if the customer does not spend enough with a solution center that focus on new sales, you will not get the love that you’re expecting.

Because the machine is so costly to feed, if you don’t make a new sale, it does not matter how talented your staff are. You’re going out of business.

You have to focus your best talents on revenue generating endeavors, basically new implementations. For the low money generators, such as support, you hand those off to junior people or cheap resources. Because post implementation support, to most companies, is a money losing operation. Solution centers of a certain size cannot live off of support services.

Refusing to Play the Game

Now to the 2nd question that client asked us “why didn’t we buy the software from you?”.

The answer to this is simple. When you’re buying a new software, you’re mostly buying from perception or the preceived quality of the company that’s proposing the software to you. When you walk into their office, they have a very beautiful office with very beautiful people. When they do their demos and presentations, it’s all done professionally with case studies and well thought out demos of the software. They even have a secretary to bring you whatever you want to drink.

If you were to come to the place where I work, I’ll be pretty embarassed to show you around. It’s a glorified office that’s 200 sq ft. with dirty walls and old furniture. But I can service you some instance coffee or water.

Now if you were a prospective customer and you walk into their office and you come to our office, which one will give you a better perception of credibility?

How I’ve been able to live and thrive in this business is because I refuse to play the game as I explained here.

Conclusion

While I was explaining this to the owner of the company, he kept saying “but this is not right, this is not right!”. Yes, everyone in the world will agree that this is not right. But this is the reality of our industry.

In the end, my response to the owner of the company was this:

1. It’s hard to find a good service company because focusing on service for existing companies is a money losing business

2. The reason why you didn’t buy from us is because on initial look, we’re pretty damn fugly.