I hate beating a dead horse to death, but there are a couple of incidences that prompted me to write this article. Navision 1.0 has been out since 1996, yet it always astounds me when I walk into a company claiming that their inventory costing and cost of goods sold is incorrect because Navision is bugged.The first question I always ask is: Have you guys ran the Adjust Cost – Item Entries process? Most of the time, I get the blank stare asking what the hell I’m talking about.

Straight from the Dynamics NAV help:

The Adjust Cost – Item Entries batch job adjusts inventory values in value entries so that you use the correct adjusted cost for updating the general ledger and so that sales and profit statistics are up to date. The cost adjustment forwards any cost changes from inbound entries, such as those for purchases or production output, to the related outbound entries, such as sales or transfers.

Basically, it will update your COGS and the Unit Cost on the item card to the correct cost that the item was brought in. Simply put, you HAVE to run this process BEFORE you do any meaningful financial and costing analysis.

It doesn’t matter what your costing method is. Doesn’t matter what your setup is. You HAVE to run this if you want to do inventory costing analysis in Dynamics NAV (Navision).

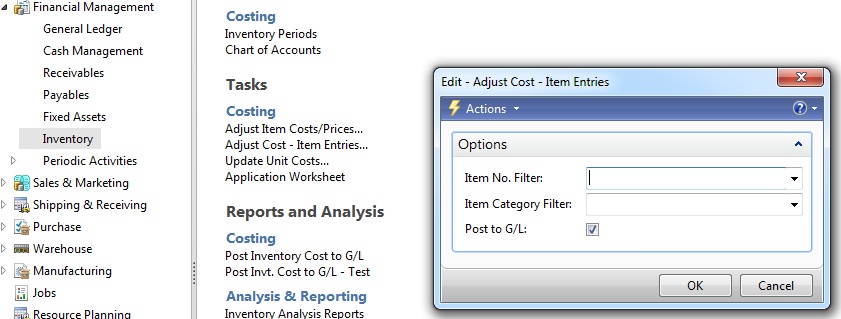

Here’s what the process looks like in RTC:

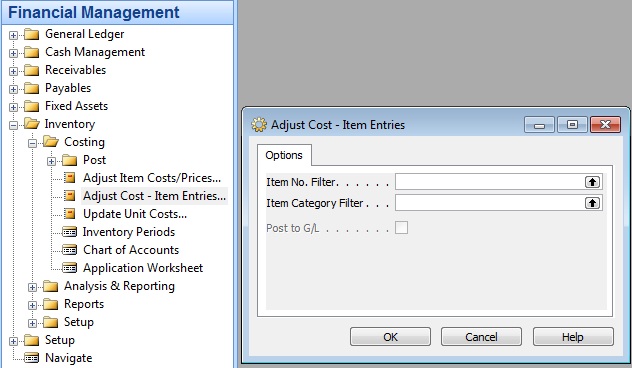

Here’s what the process looks like in Classic Client:

Note that the Adjust Cost – Item Entries will look different depending on the what version of Navision you use.

If you do not run this, no analyst in the world can begin to figure out what exactly the cost should be and address any incorrect inventory values you may have.

Side Effects

Note that if your company has never ran this before, or have not ran this in a long time, there may be detrimental affects on your inventory and COGS. Here’s a partial list of what you may encounter:

1. Your COGS on the G/L will go wild. The reason for this is that most companies, when they do not run the adjust cost, will use the general journal to “calculate” what the COGS should be. So when you do decide to let NAV do what it’s suppose to do, you will need to reverse these journal entries.

2. Your Inventory on the G/L will go wild. The reason is the same as above. The journal entries will need to be reversed.

3. Your item unit cost will go wild. The reason, again, is the same as above. A lot of times when you make an inventory journal adjustment to “take out” the inventory with the incorrect cost and positive adjust in the item with the correct cost, you are only doing it on the surface. The way NAV allocates and applies the inventory entries will most likely be different than what you adjusted.

Why Bother Going Though the Trouble?

Looking at the side affects, you may be wondering, why do I want to bother going through this process if I’m running fine as it is? The answer is simple, but it will reduce time and free up your company’s human resources to focus on important things.

Think about the manual spreadsheets and human memories that your salespeople need to figure out what cost the item should be before you can quote a competitive price to your customers. Think about the time it takes your internal accounting staff to figure out what your bottom line should look like on the financial statement. Think about if those times are freed, what other amazing things your employees can come up with to make your business even better.

Conclusion

A lot of companies will give their Trial balance to their CPA and let them make do the calculation. But realize that what they’re doing is just an estimate. It is NOT accurate. The CPA’s priority is to make the number seem reasonable so he/she can do your tax return and having paper trail if there’s an audit. His/her goal is not to get the accurate inventory cost.

Ask any good accountant, reconcilation is one of the most time consuming and useless tasks.

Ask any good salesperson, having a quote rejected because they cannot get the competitive price to the customer is not only a colossal waste of time on the company, but also for the customer. It reflects on the reputation of your company

Ask any good business owner, not having accurate profit and loss for each transaction… Well, you get the idea.

Let Dynamics NAV do its thing so it can help your business can do its thing.